Starting Point For the Active Portfolio Manager

Portfolio or investment objectives are straightforward - increase the total portfolio return based on the model that expresses the importance of every dollar of equity, for starters. The manager and accompanying personnel should be able to accurately spot fluctuations in market trends as this helps identify the proper amount of capital allocation. Reliable forecasts often lead to fair value determinations.

What Does a Private Equity Portfolio Manager Do?

On a macro level, managers monitor the portfolio's composition across all partnerships in order to mine relevant insights. It's here where they transform over-exposures and severe imbalances into performance drivers. At the fund level, contractual compliance is closely observed due to the tendency for style drift.

Ongoing performance analysis or monitoring occurs on-site. This can be explained by the fact that portfolio managers participate in the day-to-day operations of the fund. Meetings at regular intervals ensure adherence to legal and tax codes, valuation and divestment information, performance measurements, and reinvestment decisions.

Portfolio Management Strategy and Construction: Top-Down or Bottom-Up?

Spoiler: The choice between construction techniques is a moot argument. Both processes are in fact complementary to each other and are used by portfolio company managers in tandem. There are times when the research-based, bottom-up approach is more favorable compared to the more strategic-based top-down methodology, but many practitioners have found the most success in the combination of the two.

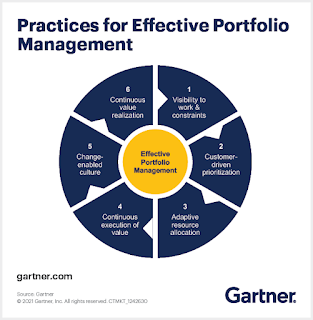

Source: Gartner

Private Equity Portfolio Liquidity Management

Described as an exceptional challenge by market participants, modeling a private equity investment program with ample liquidity in the absence of cash flows proves monumental, however, necessary. Undrawn capital sounds like a great problem to have in hindsight though. In a world of long-termism, cash is king, but you can't readily turn commitments and repayments into fiat.

Achieving high total return in the face of stringent repayment schedules and the time between distribution periods demands financial engineering and expertise in quantitative analysis mixed with intuition and market discipline. Thus far, no silver bullets exist for this particular aspect of private equity. Respecting commitment limits and ensuring low over-commitment levels is the premier solution set.

Why is Fund Valuation Important to the Portfolio Manager?

Risk assessments are closely tethered to valuation models put to use by limited as well as general partnerships. Portfolio management aptitude isn't necessarily scored in a 'pass' or 'fail' manner, but partners recognize how widely applicable a simple framework can truly be. Simply put, a high valuation for the fund conveys superior talent among portfolio leadership - those are the kind of results coveted by just about every kind of shareholder.